The sleeping partner isn't active but contributes money to run the business. Limited Partnership: A partnership with at least one general partner and one limited or sleeping partner.General Partnership: A partnership where each partner has an equal share and control of the business.Given below are the three main categories of partnerships from which members could file a Schedule K-1 form: You will have to file a K-1 form if you are part of a general partnership, limited partnership, or a limited liability company (LLC). Now that you know what a K-1 tax form is, the next question you may ask is who has to file it. Who Has to File the Schedule K-1 Tax Form?

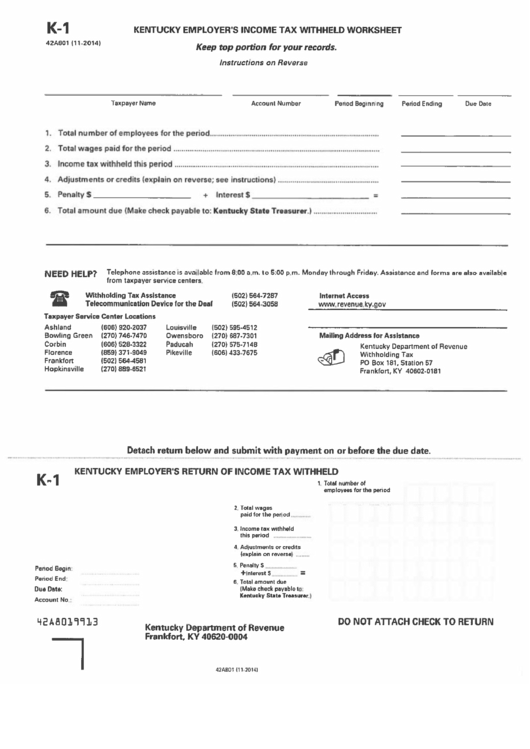

Your accountant may also pass on one for you to complete while filing Form 1065. Schedule K-1 is a downloadable form that you can get from the official website of the IRS. We guide you through all the aspects of Schedule K-1 of IRS Form 1065 to help you out. Although it can be confusing, you will find most of the boxes self-explanatory. The K-1 form requires a lot of information to be filled in before submitting. The form also features information on deductions and tax credits. It shows the details of profit sharing or losses in the past financial year. Schedule K-1 is a form that you need to complete and submit if you are a partner in a business.

0 kommentar(er)

0 kommentar(er)